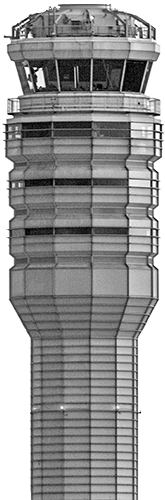

Investment in infrastructure remains a key driver for economic development. It is estimated that global investment needs will reach 3.7 trillion dollars a year through 2035 (Bridging Global Infrastructure Gaps. McKinsey Global Institute, 2017), of which a significant portion will be spent in priority markets for Ferrovial.

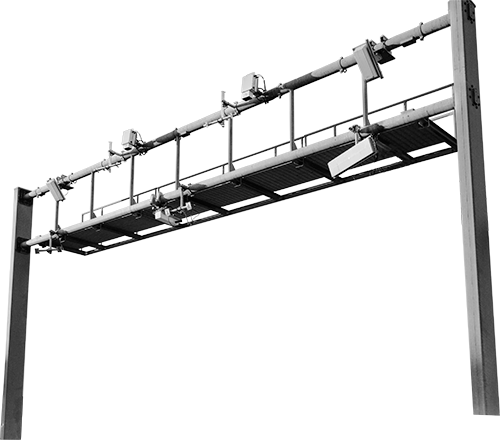

The company has infrastructure assets that have allowed differential knowledge in the management of urban congestion. This competitive advantage relates mainly to toll roads with dynamic pricing schemes where users are willing to pay different tariffs depending on the level of congestion. In 2018, infrastructure assets accounted for 80% of Ferrovial’s value and generated cash to provide 486 million euros in dividends.

The group started a strategic review of its services business in order to shape and define its long-term vision, taking into account its ability to generate value, its competitive advantages and the expected profitability of its future investments. This process could eventually lead to the sale of all or part of the existing Services portfolio.

Ferrovial focused on the services business as a valuable cash generator and to develop new capabilities in business activities related to infrastructure. Future investments will focus on infrastructure assets given current rates of return, size of existing opportunities, mainly in developed markets defined as priority for Ferrovial, the industrial knowledge acquired to date and the current cash generation from the company’s assets.

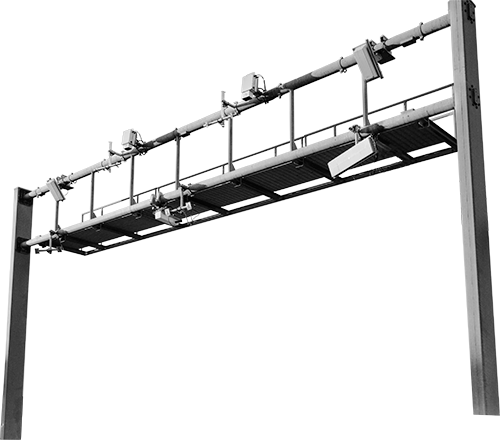

The construction business is currently facing significant challenges that impact business margins such as cost inflation or the trend towards contracts that present an unbalanced transfer of risks. The group’s Construction division, where sales are reaching ten-year highs, saw lower operating margins in 2018 and this situation is not expected to recover in the near future. Looking ahead, the business will be focused on technically complex projects that allow for greater profitability through design and the order book will be preferably linked to infrastructure projects (toll roads and airports), mainly in priority countries for the group.

BACKGROUND

Climate change, energy transition, concentration in cities, changes in mobility and technological advances are all transforming the way infrastructure is built and operated. Key considerations include:

- The global migration towards a low-emission economy is channeling investment and financing towards businesses that help meet the climate change goals set out in the Paris Agreement. These commitments are generating new opportunities for sustainable infrastructure, mobility and energy efficiency, among others.

- Population growth and urbanization are increasing congestion within cities, demanding new solutions and infrastructure. Governments face the need for significant investments limited by existing levels of indebtedness.

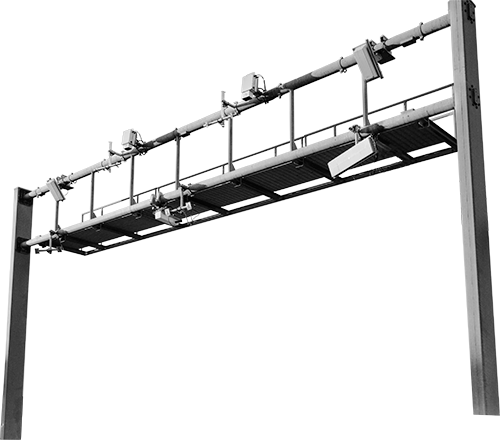

- Technology developments and digitalization improves infrastructure efficiency and productivity. Advances made in technologies such as IoT, drones, 3D printing, augmented reality and smart grids among others, is impacting the development of future infrastructure and its interaction with the end user.

- Autonomous driving, connected infrastructure, vehicle sharing and electrification will impact not only transportation infrastructure but also mobility services, opening up new business opportunities.

In this context, the main challenges facing the company will be:

- More competition: the growth in available private funding and the need to invest in the midterm, increase the interest in infrastructure investment, particularly in regions with better growth prospects and more appealing investment conditions.

FERROVIAL IS COMMITTED TO A SUSTAINABLE GROWTH, OPERATING REGULARLY IN COUNTRIES THAT HAVE EMISSION REDUCTION COMMITMENTS AND INFRASTRUCTURE ADAPTATION PLANS, OFFERING THEM INNOVATIVE SOLUTIONS

- Commercial, political and social tensions: global economic growth is currently challenged by protectionist policies, geopolitical conflicts and populist sentiment, which present new risks for economic development.

- Active and efficient management: regulation and legal security are key factors when investing and require exhaustive risk control from the contracting phase to the execution of the project.

- Long term sustainable infrastructure: technological progress is making it increasingly necessary for infrastructure planning to become more flexible to future scenarios.